Tesla’s insurance coverage merchandise are at present unsustainable, in keeping with a brand new report that exhibits the corporate is dropping cash insuring its personal automobiles.

Tesla automobiles have lengthy had a repute for being costly to insure.

The automaker tried to handle the state of affairs on a number of fronts. It launched its personal “collision facilities” to attempt to management restore prices, and it additionally launched its personal insurance coverage merchandise.

Tesla claims that no different insurer is aware of extra about its know-how and its homeowners than Tesla does, so the automaker ought to be capable to provide extra exact merchandise.

For the previous few years, Tesla has been providing its personal automotive insurance coverage in some US states. The automaker makes use of its capability to gather real-time driving information from its automobiles to create what it calls a “Security Rating. ” This rating relies on how and when drivers drive, and the corporate will increase or decreases their month-to-month premium accordingly.

The usage of Tesla’s ADAS techniques, Autopilot and Supervised Full Self-Driving, may also have an effect on premiums.

Tesla homeowners have been reporting blended outcomes when making an attempt to acquire decrease quotes from Tesla in comparison with different insurers.

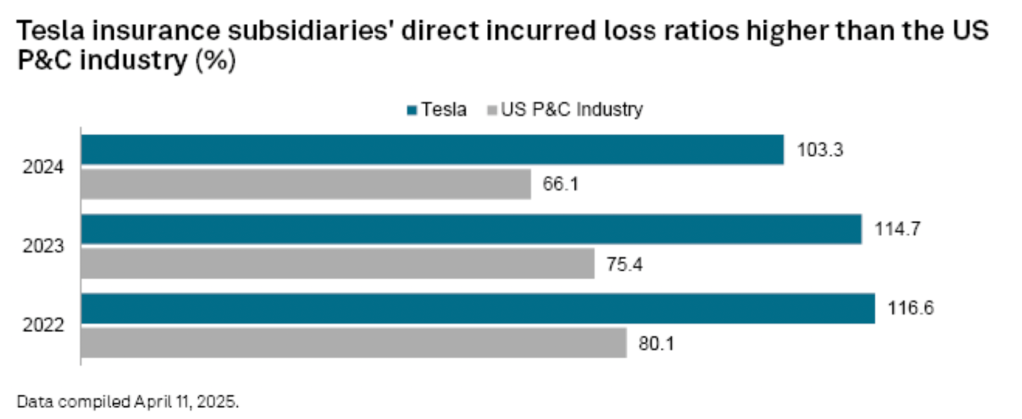

Now, information from S&P World factors to Tesla Insurance coverage having important issues:

An insurance coverage firm’s loss ratio is a key metric, because it represents the share of premiums paid out to clients. The upper it’s, the extra doubtless an insurer is prone to lose cash.

Primarily based on S&P World’s newest information, Tesla’s was at 92.5% in 2023. Because of this Tesla Insurance coverage paid out 92.5 cents in claims for each greenback it collected in premiums.

After accounting for overhead prices, it implies that Tesla was doubtless dropping cash on its insurance coverage merchandise.

In latest months, information means that insurance coverage is turning into costlier for Tesla automobiles in 2025.

Electrek’s Take

That is fairly attention-grabbing, because it straight contradicts Tesla’s declare that its automobiles are concerned in crashes at a considerably decrease fee than different automobiles and are comparatively cheap to restore.

Neither of these claims will be true if insurance coverage premiums are costly.

If it had been the case, insurance coverage prices on Tesla automobiles could be happening, and Tesla could be getting cash with its insurance coverage merchandise.

Now, S&P claims that even the latter isn’t legitimate.