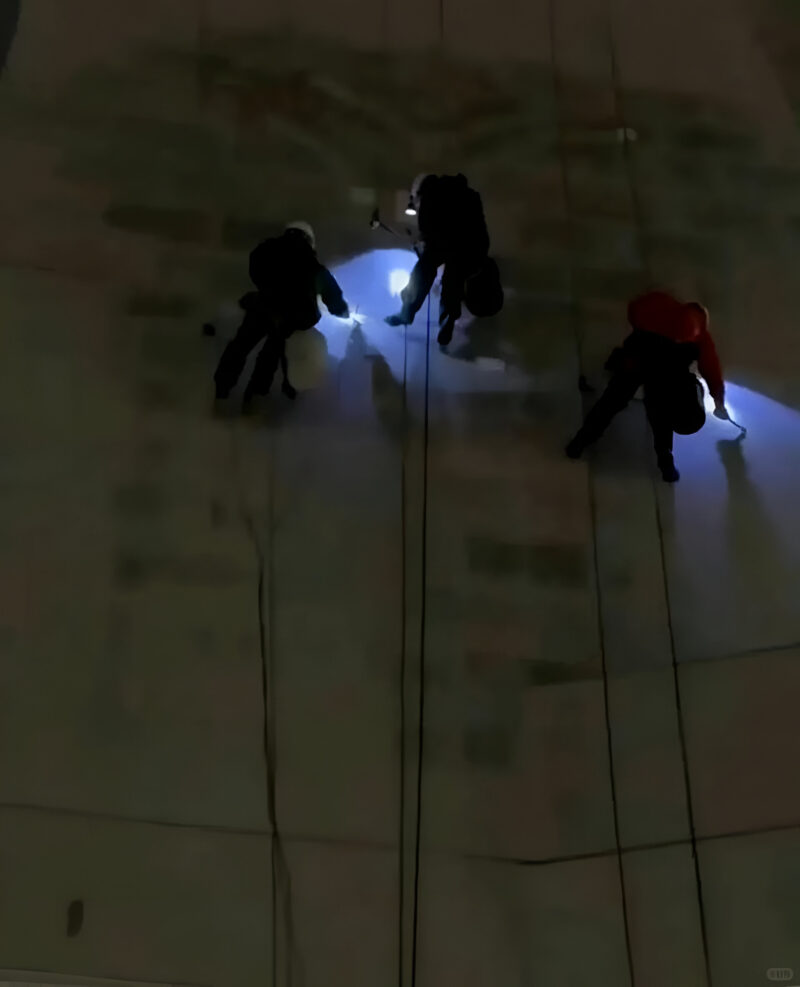

A netizen just lately posted images displaying Neta Auto’s brand being eliminated in a single day from its Shanghai HQ. Staff dismantled the signage utilizing ropes and scrapers, leaving solely faint traces. Neta confirmed the removing was because of the lease expiring final month and mentioned the corporate is getting ready to relocate, although the brand new workplace deal with hasn’t been disclosed.

As soon as thought-about a darkish horse amongst China’s electrical car (EV) startups, Neta Auto is now on the centre of an influence wrestle that might decide the corporate’s destiny. A number of sources have confirmed that state-owned shareholders of Neta’s dad or mum firm, Hozon New Vitality Vehicle, are shifting to convene a board assembly to take away founder Fang Yunzhou from his twin roles as chairman and CEO. The dramatic growth comes as the corporate grapples with staggering losses, a damaged provide chain, and manufacturing unit shutdowns.

Fang, who based Hozon in 2014 and has served as its authorized consultant since has been a central determine in Neta’s rise and fall. Though as soon as considered as an revolutionary chief, he’s now going through extreme criticism from government-linked shareholders over his dealing with of the corporate’s funds and technique. These beforehand supportive shareholders have grown annoyed after cumulative losses surpassed 18.3 billion yuan (2.5 billion USD), and the corporate’s debt ratio soared to an alarming 217%.

The stress has escalated to the purpose that one other state-owned investor is reportedly pushing for Hozon to enter chapter restructuring, signalling a possible collapse of considered one of China’s distinguished EV startups. Based on insiders, these traders demand basic structural reform relatively than a easy management reshuffle.

Neta’s mixed-ownership mannequin makes the state of affairs distinctive, combining non-public entrepreneurial management with state capital. Whereas this construction initially provided coverage and funding benefits, it has grow to be a supply of battle. State traders targeted on threat mitigation and long-term stability have clashed with Fang’s extra aggressive enlargement methods, significantly his push into Southeast Asia and his aim of turning a revenue by 2026.

The monetary collapse has additionally affected operations. Inside sources report unpaid money owed to suppliers exceeding 6 billion yuan (833 million USD), with battery big CATL amongst these halting deliveries. In consequence, Neta’s home manufacturing has stopped, additional delaying abroad orders regardless of having secured a 2.15 billion yuan (practically 300 million USD) credit score line in Thailand.

Neta’s downward spiral was already evident in its gross sales figures. After peaking in 2022 with 152,000 models, deliveries dropped to 127,500 in 2023 and plummeted by practically half in 2024 to simply 64,549 autos. Experiences of mass layoffs, retailer closures, and provider protests solely worsened public notion. Even aggressive cost-cutting, comparable to worker fairness incentives and enterprise streamlining, has did not stabilize the corporate.

Fang’s management has just lately come below even better scrutiny. After stepping in as CEO following Zhang Yong’s departure in late 2024, he set formidable objectives: a public itemizing, international enlargement, and optimistic gross margins by 2025. None have materialized, and Neta’s liquidity points have worsened. A proposed debt-to-equity swap to scale back provider debt additionally stalled, additional eroding confidence.

As state shareholders push for Fang’s ouster and even chapter proceedings, the way forward for Neta hangs within the stability. If the board vote goes by, Fang might lose management of the corporate he constructed, marking a dramatic fall from grace for one of many EV sector’s early pioneers.