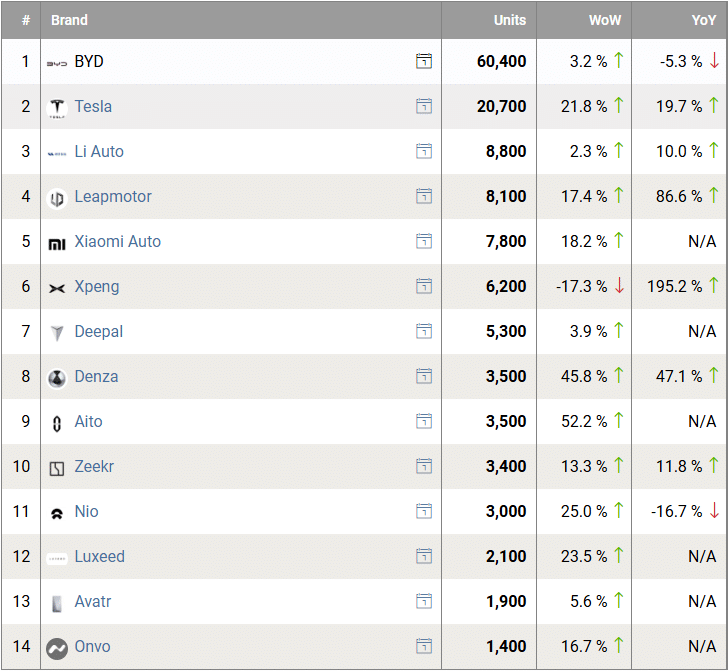

Within the final week of February, the Chinese language EV market was primarily up, with a number of exceptions. BYD was barely up 3%, Xiaomi was up 18%, Nio 25%, and Tesla 22%, whereas Xpeng was down 17% in contrast with the week earlier than. Nio’s Onvo registered 1,400 models.

483,000 passenger automobiles had been registered in China, up 8.3% from the identical interval final 12 months. The EV penetration fee was 50.1%, as 242,000 electrical automobiles had been registered, up 24.1% from the identical interval final 12 months.

The weekly gross sales had been printed by Li Auto. Nonetheless, Li Auto ceased publishing them final week after the China Affiliation of Car Producers (CAAM) “really useful” that Li Auto, the media and any third events finish it. CAAM says weekly information “undermines the business order” and “fuels vicious competitors.” Li Auto has now printed solely its personal EV registration.

The weekly information are utilized by consultants, analysts, or traders to see the gross sales pattern and forecast month-to-month deliveries. They present what number of automobiles had been registered for highway site visitors, which could be later in contrast with automakers’ self-reported month-to-month gross sales, which, in contrast to registrations, embody automobiles for showrooms, take a look at automobiles, and different makes use of.

China-controlled media have adopted CAAM’s suggestion to cease publishing weekly figures. Nonetheless, as an unbiased supply of data on the Chinese language auto market since 2010, CarNewsChina continues to publish weekly insurance coverage registrations, sourced from China EV DataTracker.

The numbers are rounded and current new vitality automobile (NEV) gross sales, the Chinese language time period for BEVs, PHEVs, and EREVs (vary extenders). To be utterly exact, it additionally consists of hydrogen automobiles (FCEVs), however their gross sales are nearly non-existent in China.

Week 13 of 2025 (W13) was between March 24 and 30.

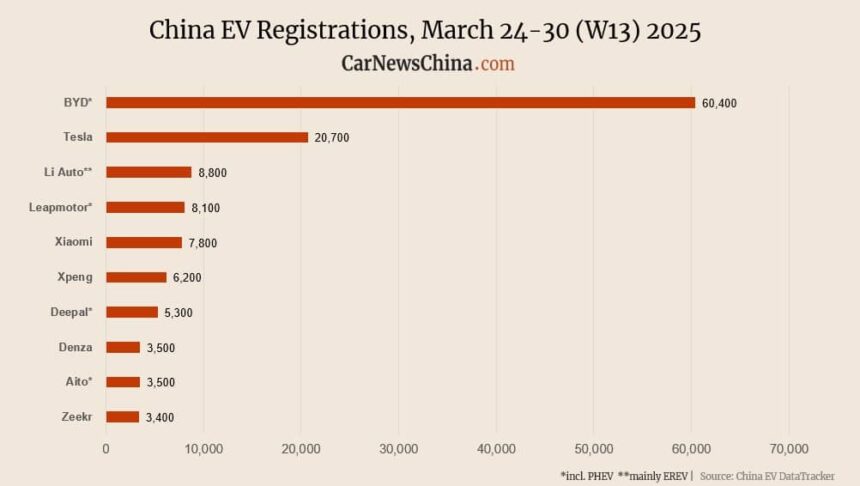

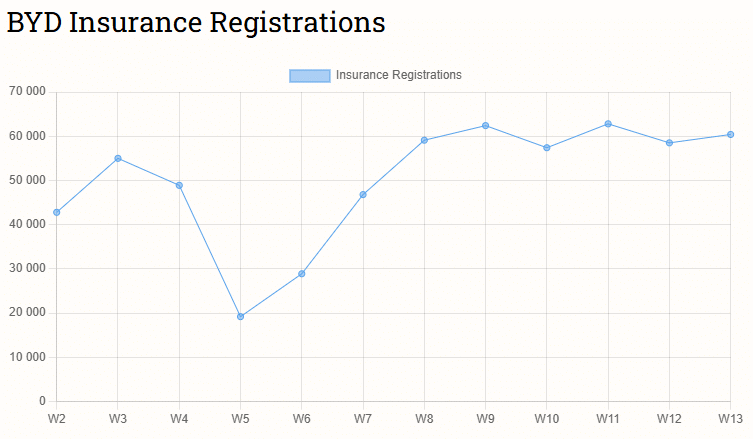

BYD led the week with 60,400 insurance coverage registrations in China, rising 3.2% from 58,500 models the earlier week. Within the first 4 weeks of March (March 3-30), BYD registered 239,100 automobiles in China. This consists of solely BYD-badged automobiles, not its subbrands.

BYD’s model Denza noticed 3,500 registrations, leaping 45.8% from 2,400 models the earlier week.

BYD bought 4.3 million automobiles in 2024 and is predicted to ship round 5.5 million models in 2025. In April 2022, BYD ceased manufacturing of ICE-only automobiles and targeted solely on EVs.

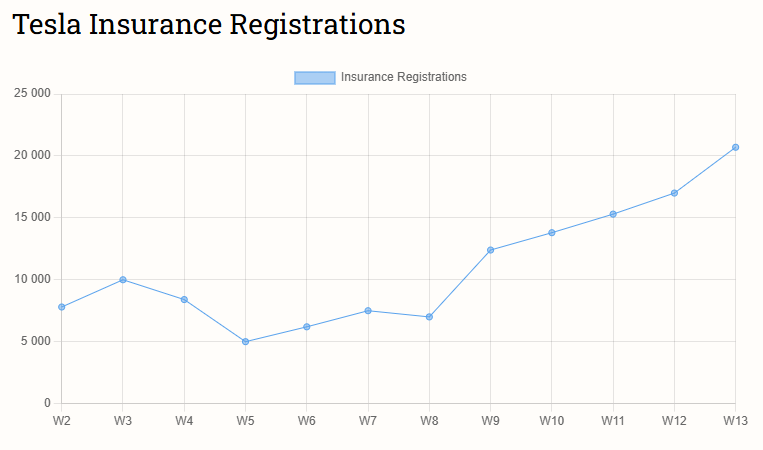

Tesla adopted with 20,700 registrations, rising 21.8% from 17,000 models per week earlier. Of those, 14,600 had been new Mannequin Y registrations and 6,100 had been Mannequin 3 sedan registrations. For Tesla, that is the fifth consecutive week of rising gross sales in China.

Within the first 4 weeks of March (March 3-30), Tesla registered 66,800 automobiles in China.

Li Auto recorded 8,800 registrations, up 2.3% from 8,600 models the earlier week. Within the first 4 weeks of March (March 3-30), Li Auto registered 32,600 automobiles in China.

Li Auto sells primarily EREV SUVs. Final 12 months, it launched its first all-electric automotive, Li Mega. Nonetheless, the gross sales had been disastrous for the coffin-like automobile. In response, Li Auto delayed the launch of one other all-electric mannequin to Q2 2025 – it is going to be an all-electric SUV, Li Auto i8, which was already teased in spy photographs.

Volkswagen-backed Xpeng posted 6,200 registrations, down 17.3% from 7,500 models the week earlier than. Within the first 4 weeks of March (March 3-30), Xpeng registered 29,200 automobiles in China.

Xpeng’s month-to-month supply quantity has exceeded 30,000 automobiles for the fifth consecutive month as the corporate introduced 33,205 delivered models in March. The Mona M03 entry-level sedan has powered its deliveries, contributing about half of the gross sales within the final three months. Mona M03 not too long ago reached 100,000 produced models, 216 days after the launch.

Stellantis-backed Leapmotor noticed 8,100 registrations, rising 17.4% from 6,900 models the earlier week. Within the first 4 weeks of March (March 3-30), Leapmotor registered 27,900 automobiles in China.

Xiaomi reported 7,800 registrations, up 18.2% from 6,600 models the earlier week. Within the first 4 weeks of March (March 3-30), Xiaomi registered 27,100 automobiles in China.

Deepal recorded 5,300 registrations, rising 3.9% from 5,100 models per week earlier.

Zeekr posted 3,400 registrations, rising 13.3% from 3,000 models the earlier week.

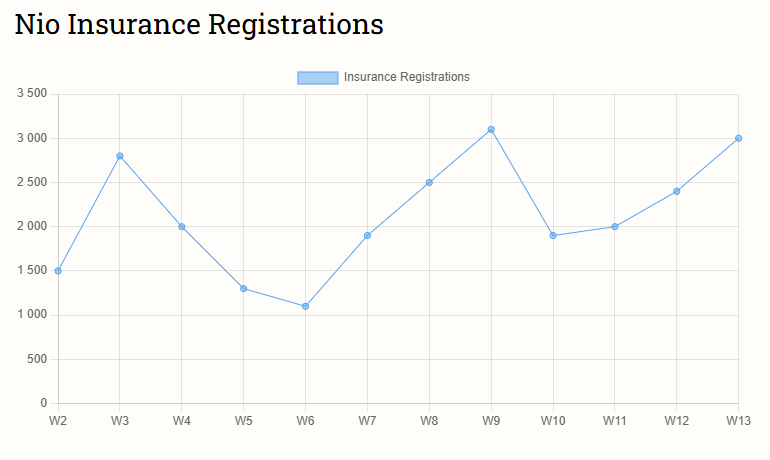

Nio registered 3,000 automobiles, up 25.0% from 2,400 models the week earlier than. Within the first 4 weeks of March (March 3-30), Nio registered 9,300 automobiles in China.

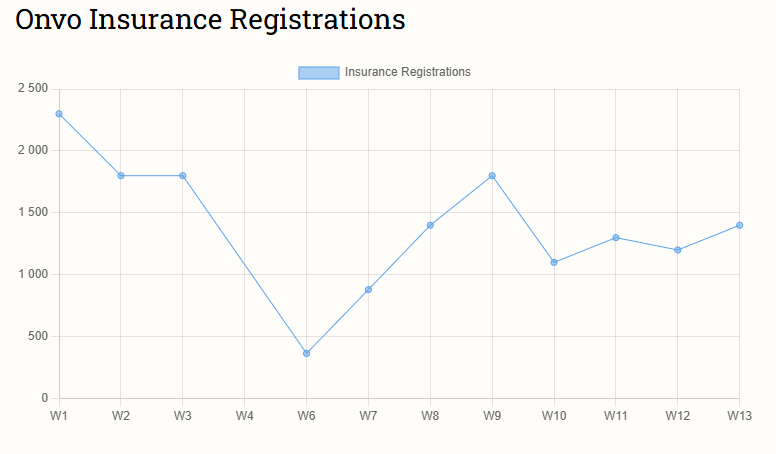

Nio’s Onvo posted 1,400 registrations, up 16.7% from 1,200 models the earlier week. Within the first 4 weeks of March (March 3-30), Onvo registered 5,000 automobiles in China.

Onvo sells a single mannequin, an L60 SUV, launched in September 2024 to compete with the Tesla Mannequin Y. Its preliminary month-to-month gross sales goal was to achieve 10,000 models in December and 20,000 in March. The December goal was achieved with little assist from promoting automobiles to its personal staff. Nonetheless, the 20,000 models goal for March wasn’t met.

Collectively, the Nio Group registered 4,400 automobiles, up 22% from 3,600 models the week earlier than. Within the first 4 weeks of March, Nio Group registered 14,300 automobiles in China.

Nio Group’s gross sales goal is about 440,000 automobiles in 2024, of which Onvo ought to contribute half. Final 12 months, the corporate delivered 220,000 automobiles.

Aito posted 3,500 registrations, rising 52.2% from 2,300 models per week earlier.

Avatr recorded 1,900 registrations, up 5.6% from 1,800 models the earlier week.

Luxeed noticed 2,100 registrations, rising 23.5% from 1,700 models per week earlier.

Replace 4:14 pm (China Time): Nio Group registered 14,300 models, not 10,300, within the first 4 weeks of March.

Beneficial for you

China EV registrations in week 12: Nio 2,400, Xpeng 7,500, Tesla 17,000, BYD 58,500

China EV registrations in Week 11: Nio 2,000, Xpeng 7,000, Tesla 15,300, BYD 62,800

China EV registrations in Week 10: Nio 1,900, Xpeng 8,500, Tesla 13,800, BYD 57,400