Regardless of quite a few delays and mounting competitors from Ford, Stellantis, and the Chinese language, the GM board determined to take $6 billion and pump its share worth as an alternative of investing within the firm’s future.

A couple of quick weeks after labor negotiations led to a six-week UAW strike at GM crops, GM board members permitted a $10 billion accelerated inventory buyback plan. This week, the board kicked off that initiative with a $6 billion buy and elevating its shareholders’ inventory dividend by 33 p.c (to 12 cents per share) within the first quarter … a transfer that, to this author, looks like a blatantly cynical cash-grab and shockingly shortsighted dereliction of the board’s fiduciary obligation to the well-being of the corporate.

Stellantis is severe

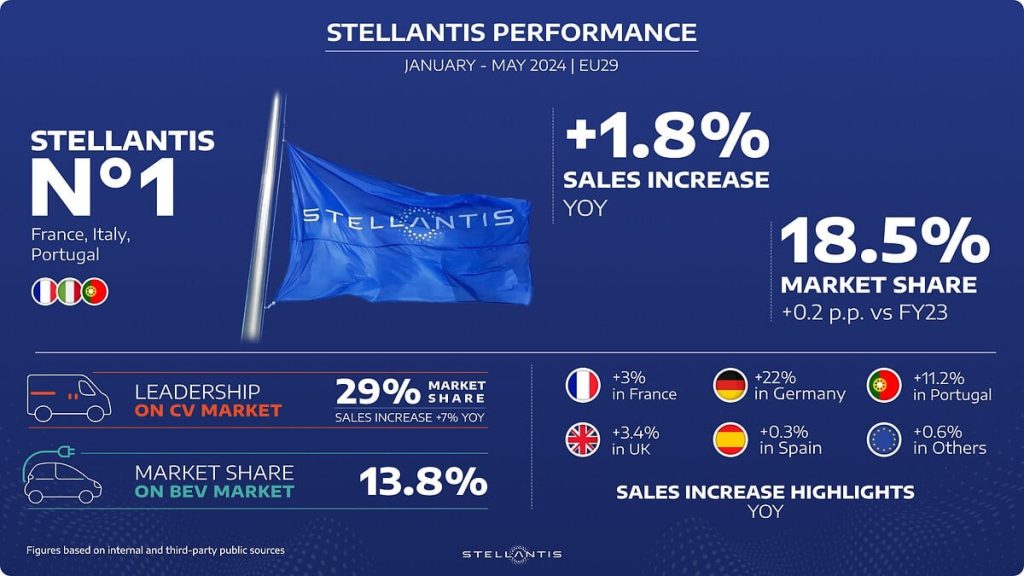

Stellantis could have been gradual to the electrical social gathering again in 2020 and 2021, when it appeared such as you couldn’t go two weeks with out some OEM or different asserting plans to go “absolutely electrical” by 2035. However the Carlos Tavares-led firm looks like it’s rising to the problem – in a giant method.

“Whereas the BEV market could also be experiencing a slowdown, Stellantis stays undeterred, capturing a 13.8% share within the EU29 area,” writes Max McDee. “The corporate’s electrical automobiles are main the cost in France, the place gross sales soared by 56% to succeed in a 37.9% market share.”

In Germany, the world’s quantity two producer of electrical automobiles, Stellantis is on a cost. The corporate’s gross sales there are up 22% over the 12 months earlier than, and it stays a market chief in Italy on the energy of its Fiat, Alfa Romeo, and well-received new Lancia choices.

To make issues worse for GM, Stellantis appears to have rediscovered the truth that Jeep is a younger, enjoyable model, and the corporate introduced plans at present to launch an “inexpensive,” $25,000, all-electric Jeep Renegade considerably prior to later.

And Stellantis isn’t even a powerful instance! GM’s arch-rival Ford is securing some high new product expertise, as nicely. The blue oval is ramping up its efforts to supply an inexpensive EV and get it to market as shortly as attainable, and its compact Maverick hybrid truck and E-Transit electrical van are dominating their respective markets

In case you take a look at import manufacturers, Hyundai and Kia are closing the hole with Tesla, experiencing double-digit progress within the EV market with out Stellantis’ benefit of getting began within the single digits. Hyundai, together with Tesla, have pushed down the worth of 300-mile, fast-charging EVs to nicely beneath the $47,218 common new automobile transaction worth.

On the identical time, Kia’s design group goes from energy to energy with automobiles like just lately up to date EV6, American-made, seven-passenger EV9, and upcoming EV3 compact all wanting like actual winners for the Korean model.

It’s not simply legacy manufacturers

Upstart carmakers like Rivian, with its compact R3 (above) are additionally coming to eat GM’s lunch with recent, modern merchandise that compete immediately with GM’s bread-and-butter choices just like the Chevy Silverado (Rivian R1T), Tahoe (R1S), and the Blazer/Equinox (R2), that are nonetheless getting crushed within the market by Tesla’s tremendous best-selling Mannequin Y.

And that’s saying nothing of the Chinese language.

China is an issue for GM

As soon as upon a time, GM might rely on China to no less than purchase some Buicks right here and there – however the home Chinese language producers have stepped up their recreation considerably up to now decade, to the purpose that it’s not clear whether or not or not Buick will nonetheless be a fascinating model on the planet’s largest auto market in five-to-ten years’ time (or within the US, for that matter).

In the meantime, GM’s huge discuss its Ultium platform bringing prices down with the economies of large scale appear to have stalled, with the corporate producing far fewer mainstream EVs just like the Silverado and Blazer than you get the sensation they’d have preferred.

What’s clearly wanted for GM to outlive the subsequent huge evolution of the auto market because it transition to electrical gasoline is extra product. Higher product. Cheaper product. And, whereas we’re at it, extra important funding in its workforce, in order that they cannot solely assist develop that subsequent era of GM EVs, however be capable of afford to purchase them, as nicely – one thing that the most recent UAW deal tried to deal with, even because it did not safe pensions for workers employed after the ’07/08 bailout.

As an alternative, GM is getting a inventory buyback. As a GM fan, I hope they rethink.