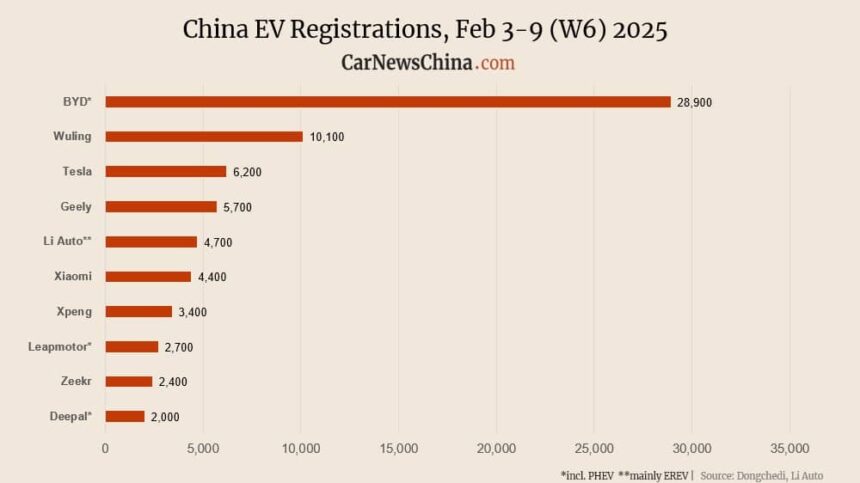

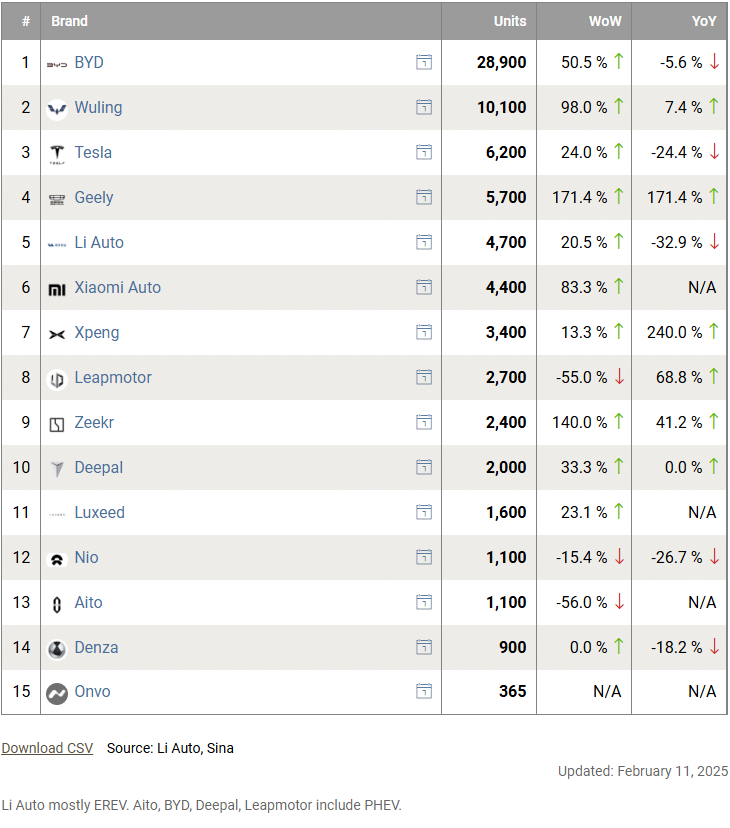

Within the sixth week of the 12 months, China’s EV market was largely up because the Chinese language New Yr vacation ended. Xiaomi was up 83%, Tesla was up 24%, BYD was up 50%, and Nio was down 15%.

Week 6 (W6) of 2025 was between February 3 and 9.

The weekly gross sales are revealed by Li Auto, and regardless of Li’s not explicitly saying it, they’re based mostly on insurance coverage registration information. The numbers are rounded and current new power autos (NEV) gross sales, the Chinese language time period for BEVs, PHEVs, and EREVs (vary extenders). To be utterly exact, it additionally contains hydrogen autos (FCEVs), however their gross sales are virtually non-existent in China. Onvo registrations usually are not revealed by Li Auto however come from China EV DataTracker.

Needless to say insurance coverage registration and gross sales/deliveries are completely different datasets. Insurance coverage registration is reported by regulator-related automotive associations, whereas gross sales are largely self-reported by automakers and would possibly embrace present vehicles and different devices.

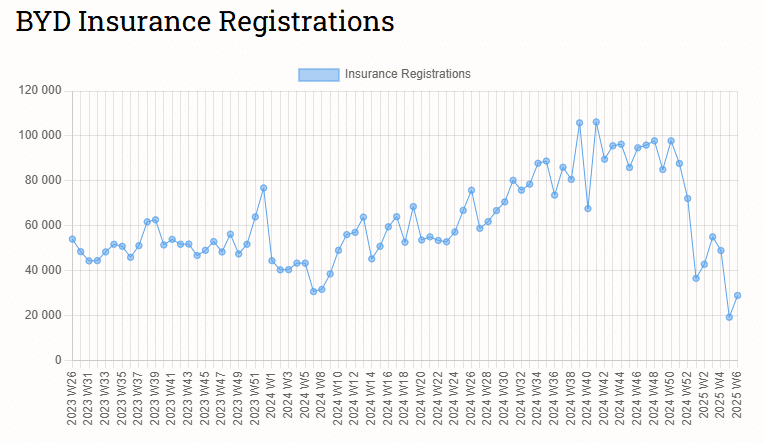

BYD acquired the primary spot with 28,900 automobile registrations, up 50.5% from 19,200 items the week earlier than. These numbers don’t embrace BYD’s manufacturers, Denza, Fang Cheng Bao, and Yangwang.

BYD group bought 296,446 passenger NEVs in January 2025, down 41.8% from 509,440 in December and up 47.5% from 201,019 the earlier 12 months.

Cumulative cumulative automobile gross sales in 2024 reached 4,250,370 autos, up 41,1% from 3,012,906 items in 2023.

Wuling registered 10,100 autos, marking a 98.0% improve from 5,100 items within the earlier week.

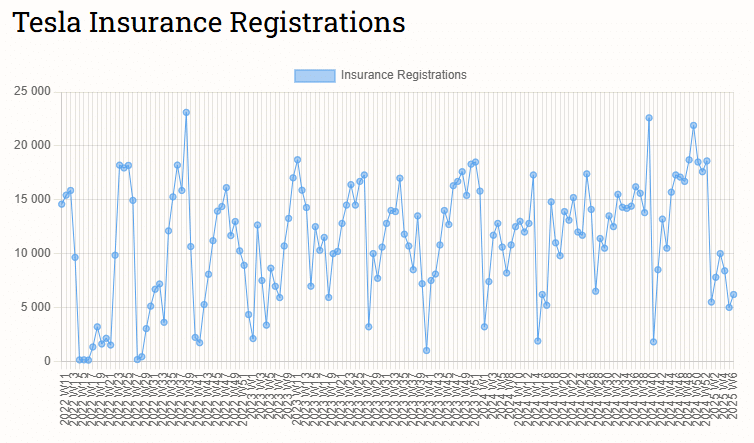

Tesla recorded 6,200 registrations, rising 24.0% from 5,000 items the prior week.

Geely noticed 5,700 registrations, up 171.4% from 2,100 items per week earlier.

Li Auto registered 4,700 autos, a rise of 20.5% from 3,900 items the earlier week.

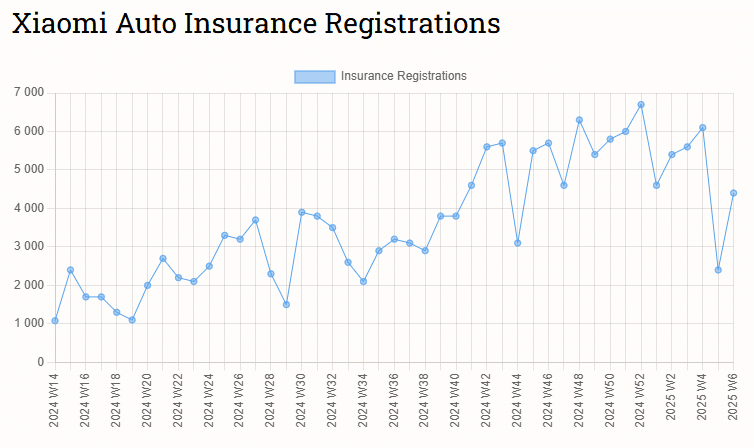

Xiaomi recorded 4,400 registrations, rising 83.3% from 2,400 items per week earlier than.

Xpeng noticed 3,400 registrations, up 13.3% from 3,000 items within the prior week.

Xpeng bought 30,350 passenger vehicles in January 2025, down 17.3% from 36,695 in December and up 267.9% from 10,668 the earlier 12 months.

Leapmotor registered 2,700 autos, down 22.9% from 3,500 items per week earlier.

Zeekr recorded 2,400 registrations, surging 140.0% from 1,000 items the earlier week.

Deepal registered 2,000 autos, a 33.3% improve from 1,500 items the week earlier than.

Luxeed noticed 1,600 registrations, up 23.1% from 1,300 items the earlier week.

Aito recorded 1,100 registrations, declining 56.0% from 2,500 items per week earlier.

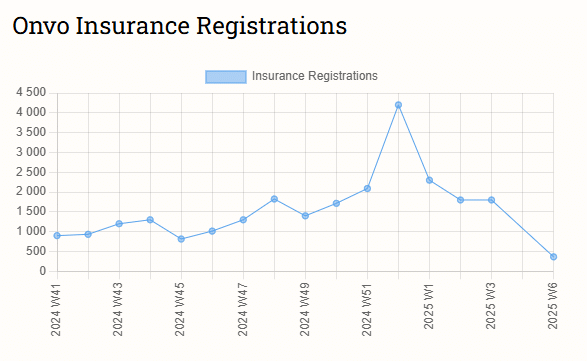

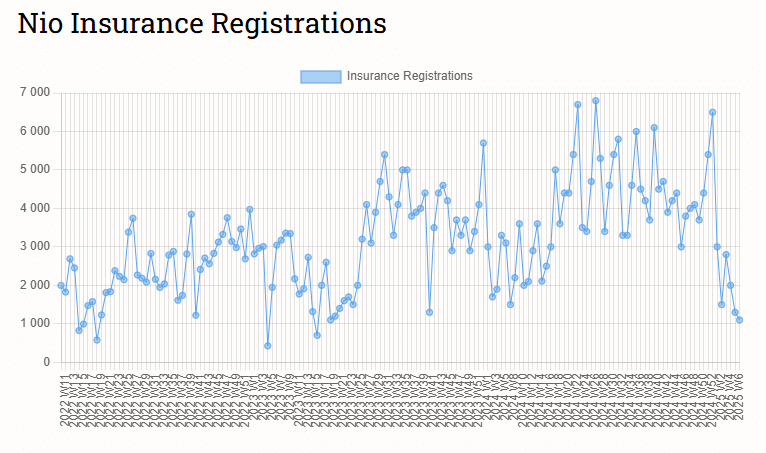

Nio noticed 1,100 registrations, down 15.4% from 1,300 items within the prior week. Onvo registered 365 items.

Nio group bought 13,863 passenger vehicles in January 2025, down 55.5% from 31,138 in December however up 37.9% from 10,059 the earlier 12 months.

Nio principal model bought 7,951 vehicles, down 21% from 10,055 items in January 2024 and 62% from 20,610 in December.

Entry-level model Onvo bought 5,912 of its solely automotive, the L60 SUV, down 44% from 10,528 items in December. Onvo launched in September, and the corporate’s president, Alan Ai, beforehand introduced that he’ll resign if the corporate doesn’t attain 10k deliveries in December.

BYD’s Denza registered 900 autos, unchanged from the earlier week.

Beneficial for you

China EV registrations in W3: Nio 2,800, Xiaomi 5,600, Tesla 10,000, BYD 55,000

China EV registrations in W2: Nio 1,500, Onvo, 1,800, Tesla 7,800, BYD 42,800

China EV registrations in W1: Onvo 2,300, Nio 3,000, Tesla 5,500, BYD 36,500