Within the second week of February, Nio was down 39%, and BYD was down 8%, whereas Xpeng was up 27% and Tesla 11%, in contrast with the week earlier than. Nio didn’t qualify for the highest ten EV startups leaderboard., Onvo registered 1,100 models.

The weekly gross sales are printed by Li Auto or Dongchedi, and regardless of Li’s not explicitly saying it, they’re primarily based on insurance coverage registration knowledge. The numbers are rounded and current new vitality autos (NEV) gross sales, the Chinese language time period for BEVs, PHEVs, and EREVs (vary extenders). To be fully exact, it additionally consists of hydrogen autos (FCEVs), however their gross sales are virtually non-existent in China. Onvo registrations should not printed by Li Auto however come from China EV DataTracker.

Needless to say insurance coverage registration and gross sales/deliveries are totally different datasets. Regulator-related automotive associations report insurance coverage registration, whereas supply knowledge are self-reported by automakers, which could embody present automobiles, take a look at automobiles, and different devices.

Week 10 of 2025 (W10) was between March 3 and 9.

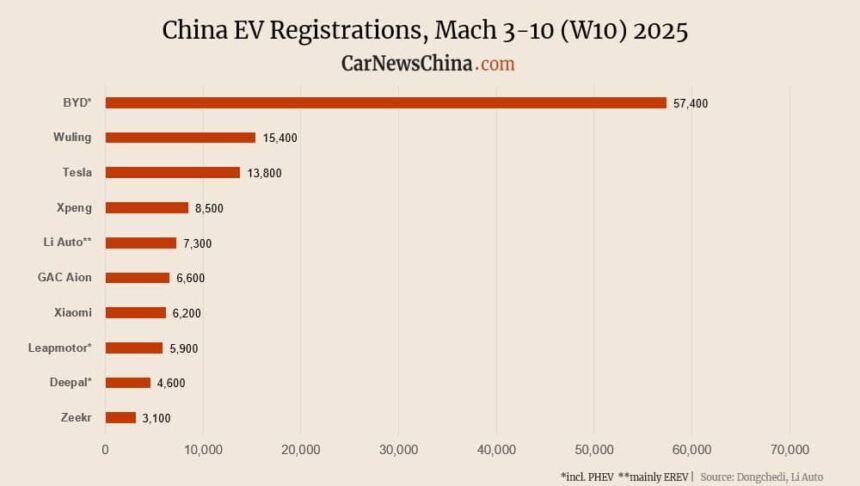

BYD remained within the prime place with 57,400 insurance coverage registrations in China, down 8.0% from 62,400 models the earlier week.

Wuling recorded 15,400 registrations, a slight decline of 1.9% from 15,700 models the prior week.

Tesla noticed a rise with 13,800 registrations, up 11.3% from 12,400 models the earlier week.

Breakdown to fashions:

- New Mannequin Y: 8,700 models

- Mannequin 3: 5,100 models

Xpeng registered 8,500 autos, rising 26.9% from 6,700 models the prior week.

Guangzhou-based automaker outsold even Li Auto and obtained the primary spot amongst EV startups. Xpeng registrations are powered by the Mona M03 entry-level sedan, contributing about half of the gross sales within the final two months.

Li Auto remained steady with 7,300 registrations, unchanged from the earlier week.

GAC Aion recorded 6,600 registrations, declining 8.3% from 7,200 models the week earlier than.

Xiaomi registered 6,200 models, down 8.8% from 6,800 models the prior week.

Leapmotor maintained regular numbers with 5,900 registrations, the identical because the earlier week.

Deepal entered the checklist with 4,600 registrations.

Zeekr noticed 3,100 registrations, down 13.9% from 3,600 models the earlier week.

Aito registered 2,600 models, dropping 31.6% from 3,800 models the prior week.

Denza recorded 2,400 registrations, rising by 4.3% from 2,300 models the earlier week.

Luxeed registered 2,300 autos, reflecting a 14.8% drop from 2,700 models within the earlier week.

Nio noticed 1,900 registrations, declining 38.7% from 3,100 models the earlier week.

Onvo registered 1,100 models of its solely automotive, the L60 SUV, down 38.9% from 1,800 models the earlier week.

Onvo CEO Alan Ai beforehand claimed that Onvo will ship 10,000 models in December and 20,000 models in March. Whereas the December goal was met, the March goal appears unlikely to be fulfilled for Nio’s entry-level model.

Onvo beforehand confronted accusations of forcing its workers to purchase an L60 SUV at a reduced workers value throughout the end-of-the-year gross sales push. Workers might then promote it again to the corporate after six months. Nio denied these allegations as particular person failure, blaming the native gross sales supervisor for being “too keen.”

Collectively, Nio Group had 3,000 registrations in China, down 38.9% from 4,900 models the week earlier than.